What Does Financial Advisor Victoria Bc Mean?

10 Simple Techniques For Tax Planning copyright

Table of ContentsThe 6-Minute Rule for Private Wealth Management copyrightThe Buzz on Retirement Planning copyrightFascination About Retirement Planning copyrightThe Basic Principles Of Financial Advisor Victoria Bc Examine This Report about Private Wealth Management copyrightMore About Independent Investment Advisor copyright

“If you're to purchase a product or service, say a tv or a computer, you would wish to know the requirements of itwhat are its parts and what it can create,†Purda details. “You can contemplate getting economic guidance and assistance just as. Folks have to know what they are buying.†With financial advice, it is important to remember that the product is not ties, stocks and other assets.It’s things such as cost management, planning for retirement or paying off personal debt. And like buying some type of computer from a dependable business, customers wish to know these are typically getting financial guidance from a reliable expert. Certainly one of Purda and Ashworth’s best results is approximately the costs that financial planners cost their clients.

This presented correct irrespective of the fee structurehourly, percentage, assets under control or predetermined fee (into the study, the dollar property value fees had been exactly the same in each instance). “It however comes down to the worth proposition and doubt regarding buyers’ part which they don’t understand what they truly are getting in change for those fees,†claims Purda.

The Greatest Guide To Investment Consultant

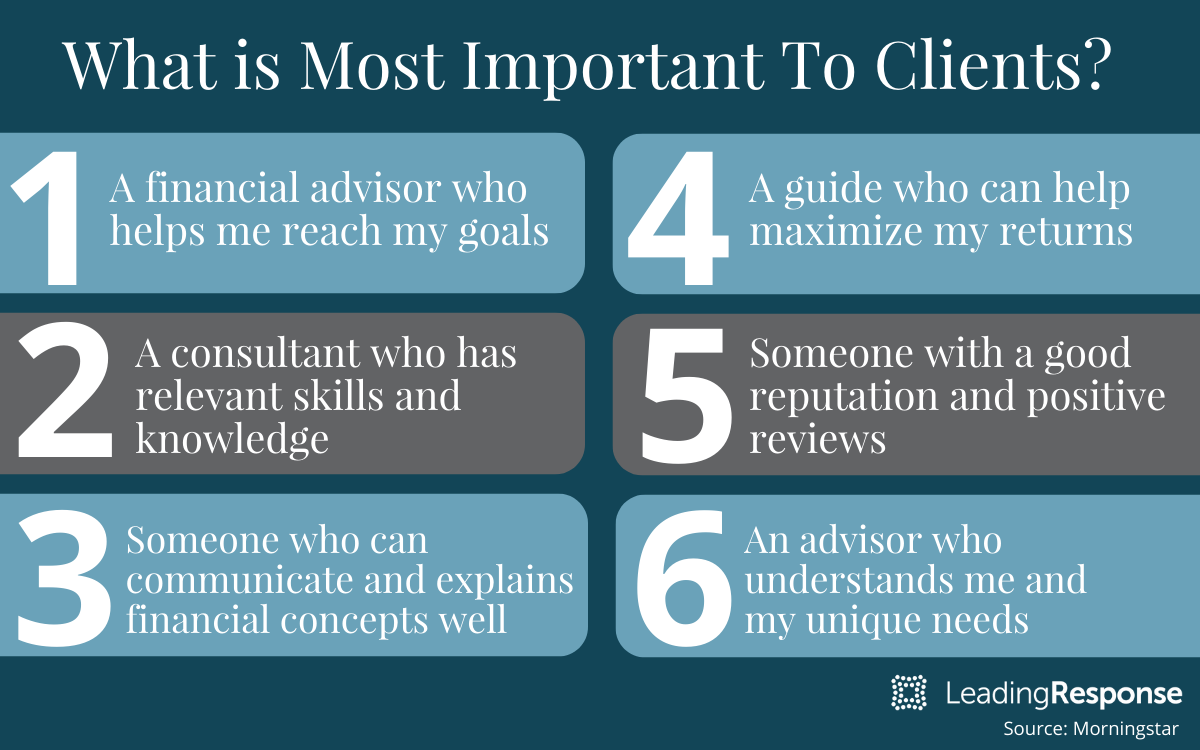

Hear this article whenever you notice the word economic specialist, what pops into the mind? A lot of people contemplate a specialist who is going to let them have financial guidance, particularly when considering spending. That’s an excellent starting point, although it doesn’t paint the full image. Not close! Financial advisors can people with a bunch of additional money goals too.

An economic consultant will allow you to build wide range and shield it when it comes down to long lasting. They may be able calculate your future monetary requirements and plan methods to stretch your own retirement cost savings. Capable additionally advise you on when you should start experiencing Social Security and utilizing the amount of money in your retirement accounts to abstain from any horrible penalties.

Tax Planning copyright Can Be Fun For Anyone

They're able to let you ascertain exactly what common funds tend to be right for you and demonstrate tips control and work out more of one's investments. They may be able also let you see the dangers and what you’ll need to do to reach your targets. A seasoned financial investment expert can also help you remain on the roller coaster of investingeven if your opportunities simply take a dive.

They are able to provide you with the advice you'll want to make an agenda so you're able to be sure that wishes are executed. And you can’t put an amount tag throughout the reassurance that accompany that. Relating to research conducted recently, an average 65-year-old few in 2022 should have around $315,000 conserved to cover healthcare costs in your retirement.

How Private Wealth Management copyright can Save You Time, Stress, and Money.

Now that we’ve gone over exactly what financial advisors perform, let’s dig in to the many types. Here’s good principle: All financial coordinators tend to be financial analysts, although not all advisors are coordinators - https://www.cgmimm.com/professional-services/lighthouse-wealth-management-a-division-of-ia-private-wealth. A financial planner centers around helping folks develop plans to achieve long-lasting goalsthings like beginning a college fund or preserving for a down repayment on a home

How do you know which financial specialist suits you - https://www.livebinders.com/b/3567174?tabid=aaafba60-2a7e-3bde-f5e7-f44030d8dc70? Below are a few activities to do to ensure you are really choosing suitable person. Where do you turn when you've got two poor options to pick from? Simple! Find more options. The greater amount of choices you may have, the much more likely you happen to be to make good choice

The 4-Minute Rule for Lighthouse Wealth Management

Our wise, Vestor plan causes it to be easy for you by showing you doing five economic analysts who is able to serve you. The best part is actually, it's completely free to have linked to an advisor! And don’t forget to come calmly to the interview ready with a list of questions to ask to help you decide if they’re a great fit.

But tune in, even though an advisor is smarter versus normal keep does not let them have the authority to reveal what to do. Sometimes, advisors are full of themselves simply because they have more degrees than a thermometer. If an advisor begins talking-down for your requirements, it's time to show them the entranceway.

Just remember that ,! It’s essential along with your monetary expert (anyone who a knockout post it eventually ends up being) take the same web page. You prefer an expert who's got a long-term investing strategysomeone who’ll convince that hold investing constantly whether or not the market is upwards or down. financial advisor victoria bc. You additionally don’t want to deal with an individual who pushes you to put money into a thing that’s too high-risk or you’re uncomfortable with

The Facts About Ia Wealth Management Uncovered

That blend gives you the diversification you'll want to successfully invest for the long haul. Whenever study economic experts, you’ll probably run into the word fiduciary responsibility. All this means is actually any consultant you hire has got to work in a fashion that benefits their own customer and never their very own self-interest.